Know How Insurance Credit Scores Affect Your Rates?

Insurance credit score can impact your car insurance rates as most companies consider it to decide whether or not to sell you a quote and how much it will cost.

How Your Credit Score Can Affect Your Insurance Rates?

In different states of the United States, many insurance companies consider your credit scores when preparing your insurance quotes. This can increase your premiums budget and it can be difficult for you to manage additional expenses.

The reason for this practice is research that defines a clear correlation between the credit management of a person and the probability of insurance. If you have a low car insurance credit score, then chances are there most companies may increase your premiums due to a poor credit history.

How Much Does Your Credit Rating Affect Insurance Rates?

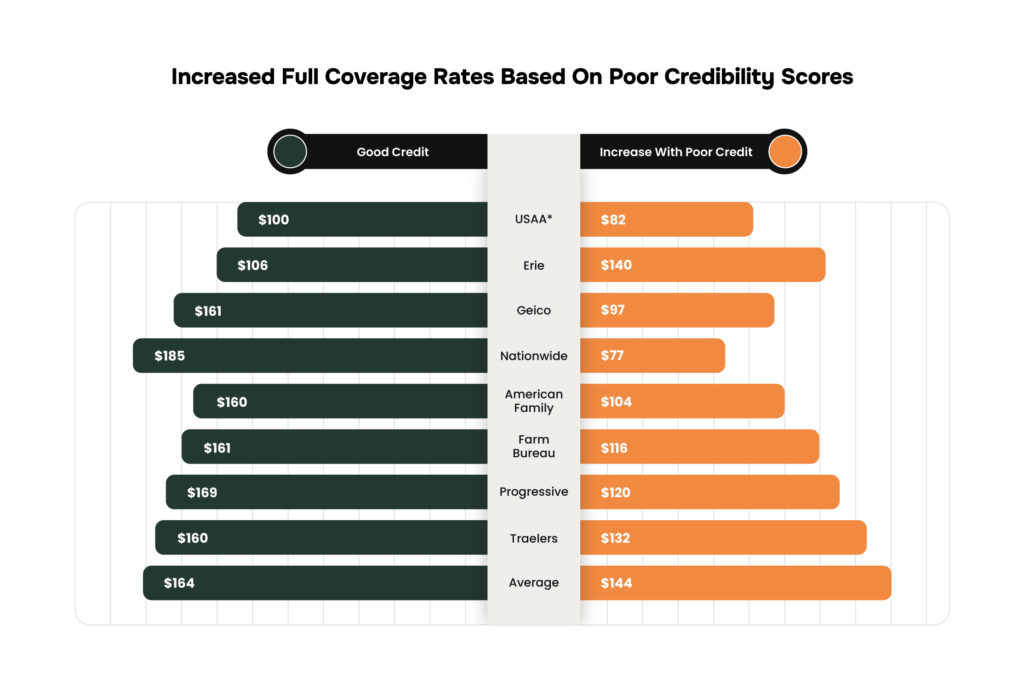

A poor credit history can increase your insurance premiums by 86% when compared to a good credit history. In the United States, drivers with a poor credit history pay $144 monthly for their full coverage premiums due to car insurance for bad credits. Also, the premiums can vary from company to company.

How Does Credit Score Impact Insurance Premiums by State?

The credit score impacts insurance within various states. The reason is that rules and regulations set by Jurisdictions allow companies to consider this factor while deciding premiums. This practice leads to changing rates across states due to various factors, including:

- Weather patterns

- Population density

- Traffic conjunction in local areas

- Cost of living

Annual Full Coverage Premium by State and Credit Rating

The following tale shows clear insights into varying premiums rates against different credit scores, based on data gathered for different states of the US.

| Poor | Average | Good | Excellent | |

|---|---|---|---|---|

| Alabama | $3,841 | $2,375 | $2,191 | $1,927 |

| Alaska | $3,888 | $2,519 | $2,330 | $2,023 |

| Arizona | $5,779 | $2,813 | $2,556 | $2,191 |

| Arkansas | $3,866 | $2,377 | $2,186 | $1,944 |

| California* | $2,700 | $2,700 | $2,701 | $2,700 |

| Colorado | $4,749 | $2,846 | $2,605 | $2,122 |

| Connecticut | $3,946 | $2,572 | $2,122 | $1,610 |

| Delaware | $4,246 | $2,847 | $2,613 | $2,245 |

| Florida | $8,578 | $4,443 | $3,941 | $3,199 |

| Georgia | $4,385 | $2,816 | $2,609 | $2,271 |

| Hawaii* | $1,655 | $1,656 | $1,655 | $1,655 |

| Idaho | $2,081 | $1,493 | $1,416 | $1,280 |

| Illinois | $3,963 | $2,480 | $2,303 | $1,961 |

| Indiana | $3,013 | $1,785 | $1,630 | $1,363 |

| Iowa | $3,316 | $1,867 | $1,680 | $1,418 |

| Kansas | $5,061 | $2,873 | $2,619 | $2,205 |

| Kentucky | $5,061 | $2,822 | $2,540 | $2,139 |

| Louisiana | $7,094 | $3,970 | $3,609 | $3,016 |

| Maine | $2,842 | $1,637 | $1,497 | $1,291 |

| Maryland | $4,524 | $2,727 | $2,491 | $2,150 |

| Massachusetts* | $1,682 | $1,682 | $1,683 | $1,682 |

| Michigan* | $7,015 | $3,749 | $3,336 | $2,684 |

| Minnesota | $4,287 | $2,212 | $1,982 | $1,679 |

| Mississippi | $3,890 | $2,267 | $2,049 | $1,766 |

| Missouri | $5,706 | $3,421 | $3,164 | $2,614 |

| Montana | $3,942 | $2,395 | $2,235 | $1,906 |

| Nebraska | $3,785 | $2,183 | $1,984 | $1,685 |

| Nevada | $5,415 | $3,745 | $3,535 | $3,084 |

| New Hampshire | $3,342 | $1,801 | $1,625 | $1,322 |

| New Jersey | $5,361 | $2,970 | $2,547 | $1,909 |

| New Mexico | $4,218 | $2,381 | $2,204 | $1,866 |

| New York | $8,812 | $4,269 | $3,833 | $3,127 |

| North Carolina | $2,220 | $1,774 | $1,708 | $1,647 |

| North Dakota | $3,301 | $1,824 | $1,619 | $1,324 |

| Ohio | $2,867 | $1,639 | $1,498 | $1,244 |

| Oklahoma | $4,628 | $2,782 | $2,536 | $2,172 |

| Oregon | $3,289 | $2,020 | $1,846 | $1,609 |

| Pennsylvania | $4,172 | $2,965 | $2,790 | $2,443 |

| Rhode Island | $4,691 | $3,058 | $2,682 | $2,341 |

| South Carolina | $3,463 | $2,041 | $1,872 | $1,516 |

| South Dakota | $4,083 | $2,160 | $1,946 | $1,604 |

| Tennessee | $3,462 | $2,023 | $1,806 | $1,498 |

| Texas | $5,010 | $2,943 | $2,613 | $2,291 |

| Utah | $3,326 | $2,083 | $1,916 | $1,636 |

| Vermont | $2,349 | $1,457 | $1,347 | $1,183 |

| Virginia | $3,747 | $2,161 | $1,960 | $1,606 |

| Washington | $1,899 | $1,664 | $1,613 | $1,530 |

| Washington, D.C. | $6,377 | $2,822 | $2,430 | $2,032 |

| West Virginia | $3,602 | $2,057 | $1,858 | $1,549 |

| Wisconsin | $3,091 | $1,906 | $1,726 | $1,451 |

| Wyoming | $2,484 | $1,685 | $1,582 | $1,340 |

Do Insurance Companies Check Your Credit?

Yes, insurance companies check your credit score insurance because it is believed that drivers with a poor credibility score tend to file more claims. Such clients prove to be very expensive to deal with for companies. This is why, these kinds of people do not get average rates.

Not Only Credit Affects the Insurance Rates

An insurance score is an important factor for your home and auto insurance premiums. Compared to things like your claims history and the value of your home or car, your insurance score has less impact on your premium.

Your insurance company agent explains how much your insurance scores are important at the time of setting the rates. Here, you shouldn’t be worried because those who have high insurance scores pay less.

Does an Insurance Quote Hurt Your Credit Score?

Getting insurance quotes would not affect your credit score. It is a good idea to get new quotes every six months to a year to make sure you’re getting the best deal.

A record of the credit check and a soft inquiry all are added to your credit file at the time when the insurance company checks your credit. If you see a copy of your credit report, you will definitely see this credit inquiry. If you talk about soft inquiries, then remember it won’t impact your credit scores.

On the other hand, if you talk about hard inquiries, then these can affect your insurance credit risk scores negatively.

What Additional Factors Affect Car Insurance Rates?

While insurance credit score is not a primary factor for insurance purchase, but many copanies still consider it while selling you quotes. Many of these consider some additional factors as well, which include:

Your Driving Record

If you have a clean driving record, it can help lowering your premiums.

Your Residence Location

Your location also matters a lot in either increasing or decreasing your insurance premiums. If threats like theft, vandalism, or accidents are very common in your state, your car insurance rates will be higher.

Your Demographics

Your running age, marital status, and gender can also impact your rates in most of the states in the US.

Vehicle Type

This is a very important factor to keep in mind while buying a car. An expensive car will have higher insurance rates and vice versa.

Insurance Types

Auto insurance is itself a parent term. It consists of various daughter insurance packages like liability, collision, and comprehensive. Every package has its own deductibles and it can impact your rates as well.

Discounts

If you purchase multiple insurances from the same company, then discounts can keep you safe from extra spending. Yes, even Auto Insurance Trade gives you special discounts for buying a home and auto insurance at the same time.

Related: Want to know about doubling insurance discounts in detail? Click “here”

How to Improve Your Credit Score Before Applying for Car Insurance?

If you want cheaper car insurance in case you have car insurance bad credit, then increase your credit score by following these tips:

Pay Bills On Time

When you pay your bills on time monthly, you build stronger trust and it shows that you can manage your financial issues responsibly.

Lower Credit Card Debt

Try to keep a low balance or full payments monthly.

Manage Existing Credit

If you have credit cards, then keep your credit cards or car loans in a good position.

Apply For New Credit Carefully

Avoid applying for new credits again and again because it can lower your credibility score.

Related Questions

What are two types of credit inquiries?

Types of insurance credit scores include:

Soft Credit

It’s a credit check that never directly affects your credibility scores anyway.

Hard Credit

This type of inquiry occurs when you intend to purchase a new credit or insurance service.

Does getting insurance quotes affect credit?

Not at all! Most companies check your credit scoresense with a soft pull, which does not impact your score so much.

Does changing car insurance affect credit score?

No, it does not affect your car insurance credit score.

How can I improve my credit-based insurance score?

- Pay bills on time: Paying your bills on time is necessary for achieving a good credit-based insurance score.

- Manage credit card debt: Managing credit card debt is very important. So try to keep your credit card balance low or aim for full payment monthly.

- Minimize credit inquiries: Try to minimize credit inquiries and dont apply for too much new credit.